Banking Dashboard

Implement advanced financial data analytics solutions to smoothly manage monetary transactions, assets, marketing campaigns, crediting risks, forecasting trends, adhering to compliances, and others. With the help of diverse BI and data visualization tools, our dedicated team creates interactive banking dashboards.

Trusted by conglomerates, enterprises, and startups

What is Power BI Banking Dashboard?

A Bank dashboard is an optimized tool created by using advanced technologies like Power BI and others to provide real-time data analysis. Consolidating data from diverse sources like CRM platforms, banking software, internal and external data systems. These dashboards for banking operations simplify complex data to ensure a smooth decision-making process for banks, financial institutions, and other financial management bodies.

The custom banking dashboard is a centralized platform that helps monitor, analyze, and manage crucial data in real-time uninterrupted. This assists in making data-driven decisions by focusing on performance trends, customer behavior, and operational efficiencies.

Live Dashboard

Strengthen your networks with key cybersecurity analytics on a live dashboard. X-Byte Analytics’ live dashboards for cybersecurity make tracking and managing critical cybersecurity KPIs super easy. The dashboard presents all critical metrics, from threat detection rates to incident response times.

Get Power BI Dashboard

Why to Use a Banking Dashboard?

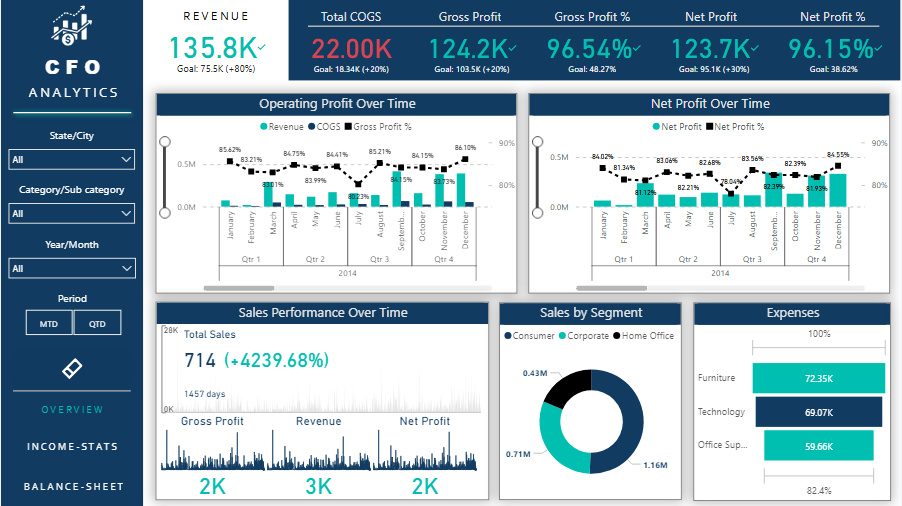

Power BI banking dashboard acts as a strategic tool that helps in aligning organizational goals with key performance metrics. This visibility helps forecast, plan, and implement corrective measures, ensuring the bank remains competitive and compliant with regulations.

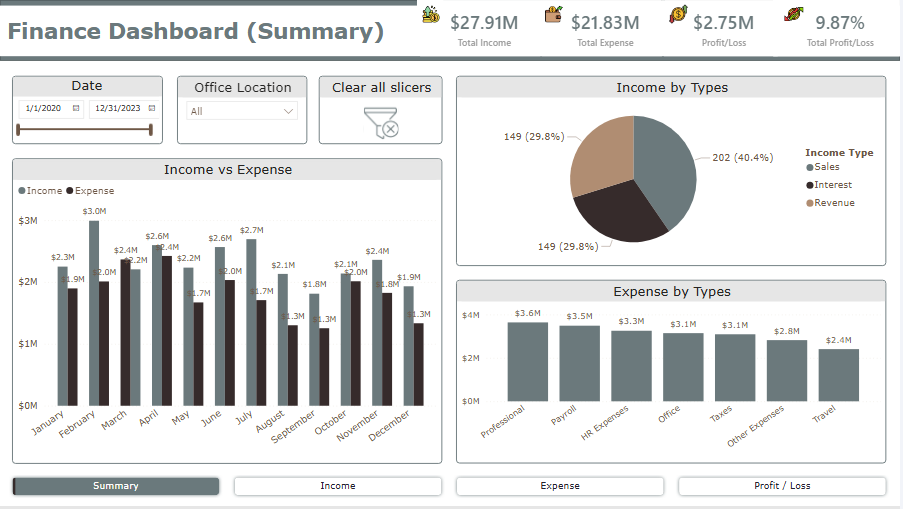

By implementing the Power BI banking dashboard, banks can comprehensively analyze diverse banking metrics such as loan performance, deposit growth, revenue trends, customer satisfaction, and risk exposure. These KPIs can be seamlessly presented into charts, graphs, and reports to get custom data analytics in banking by implementing customizable filters and drill-down capabilities.

What are the Benefits of a Banking Dashboard?

The banking analytics dashboard ensures agility, fostering innovation, and maintaining a competitive edge in the banking industry. Banks and financial institutions can integrate data sources in real-time to reduce errors and save time. Let’s understand some more of the benefits of implementing a banking dashboard.

Custom banking dashboard solutions for financial institutions provide real-time data insights into key performance metrics, revenue, expenses, customer trends, and marketing campaigns.

The banking analysis Power BI dashboard helps identify and mitigate risk factors by utilizing advanced analytics and predictive modeling tools. It includes credit defaults, fraud, or market volatility.

Decision-makers can determine sales trends and customer demand through detailed insights into market performance to boost overall revenue. The modern banking analytics dashboard helps optimize marketing campaigns by identifying cross-selling and up-selling opportunities.

The banking operations dashboard consolidates large amounts of data from multiple systems into a single platform. Streamlining the workflows helps reduce the time and effort to generate reports.

Types of Power BI Banking Dashboard

Get an interactive Power BI dashboard based on your unique business needs to streamline the analysis process. Our expertise in modern technologies allows us to create engaging dashboards by compiling diverse financial data.

Bank performance dashboard

Benefits of Bank performance dashboard

- Simplify performance monitoring

- Identify trends for strategic planning

- Improve transparency across departments

- Facilitates benchmarking against competitors

Executive Summary Dashboard

Benefits of Executive Summary Dashboard

- Save time with high-priority data

- Improve alignment with business goals

- Fosters data-driven decisions

- Snapshot of overall bank health

Loan Summary Dashboard

Benefits of Loan Summary Dashboard

- Track loan disbursement trends

- Optimizes loan repayment strategies

- Ensure compliance with lending regulations

Banking Risk Analytics Dashboard

Benefits of Banking Risk Analytics Dashboard

- Mitigate risks with early detection

- Enhance regulatory compliance

- Tracks and manages credit risk

- Improve risk-response strategies

Retail Banking Analytics Dashboard

Benefits of Retail Banking Analytics Dashboard

- Track customer acquisition

- Analyze product profitability

- Optimize team performance

- Tailored customer services

Fraud detection dashboard

Benefits of Fraud detection dashboard

- Detects anomalies in real-time

- Proactive fraud prevention

- Improves efficiency in fraud investigation

CRM Dashboard

Benefits of CRM Dashboard

- Enhance customer retention

- Track customer feedback and KPIs

- Improve team performance

- Streamline communication

Treasury management dashboard

Benefits of Treasury management dashboard

- Enhance liquidity management

- Optimize cash flow

- Track investment performance

- Improves financial stability

Sales and Marketing Banking Dashboard

Benefits of Sales and Marketing Banking Dashboard

- Monitor the effectiveness of strategies

- Data-driven insights

- Boost sales performance

- Analyzes ROI for campaigns

Transform Your Banking Data with our Dashboards

Case Studies

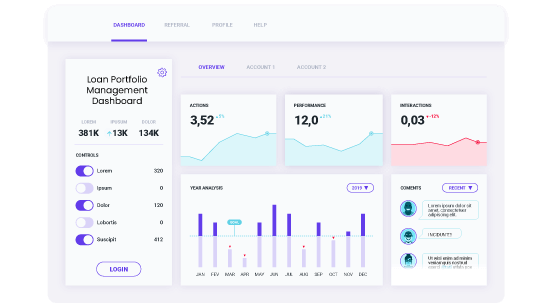

Improving Loan Portfolio Management

Overview

Global Bank Corp was a well-known banking chain, faced difficulties in managing its loan portfolio due to delayed insights and a growing number of non-performing loans (NPLs).

Challenges

Manual reporting processes delayed the identification of risky loans, resulting in a high NPL ratio and increased financial losses. The lack of timely insights made proactive decision-making challenging.

Solutions

The bank has implemented a loan portfolio management dashboard that displays real-time data on NPL ratios, loan recovery rates, and branch-level credit risk exposure. This allowed the bank to take corrective actions promptly.

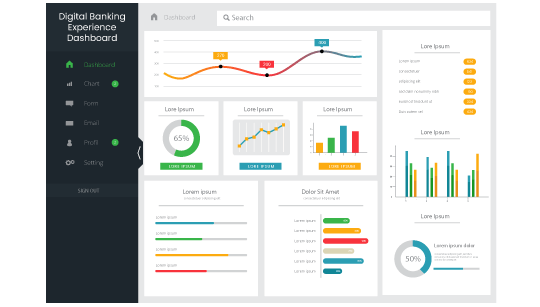

Enhancing Digital Banking Experience

Overview

TechFirst Bank was a streamlined digital banking organization. Who wanted to increase the adoption of its digital banking services but faced challenges with low user engagement and high drop-off rates during online transactions.

Challenges

The bank lacked clear visibility into customer behavior on its digital platforms, making it difficult to pinpoint issues affecting user experience.

Solutions

A digital banking dashboard was created to track metrics such as user activity, transaction success rates, and engagement trends. Insights from the dashboard helped identify pain points and solve them for streamlined operations.

Audience

KPIs

How to Create a Power BI Banking Dashboard?

With extensive experience in providing corporate and retail banking dashboards, we deliver interactive and optimized solutions. This banker dashboard is created by following pre-determined steps:

Our dedicated Power BI developers discuss with the clients to analyze their project requirements and the type of dashboards they require. This helps us in creating ideal financial data analytics dashboards to fulfill their unique requirements.

After analyzing the needs of our clients, we create a prototype of a banking analysis Power BI dashboard by establishing the required integrations. We then create interactive dashboards to provide a comprehensive view of banking processes.

We then test the custom bank dashboards to ensure secured financial reporting and analysis. If there are any bugs, we solve them and deploy the solution for the use of key banking personnel.

Our experts provide uninterrupted support and time-to-time maintenance service for the banking performance dashboard. This helps in ensuring constant performance and streamlined operations.